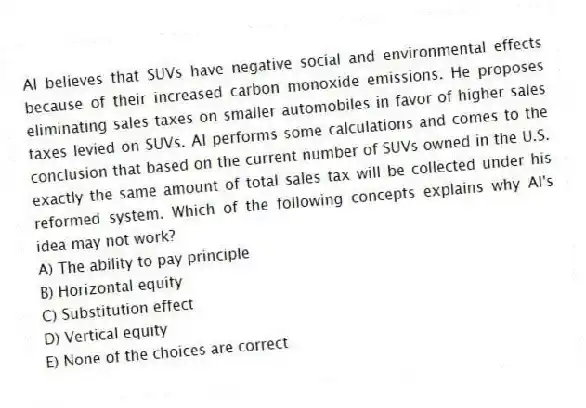

Al believes that SUVs have negative social and environmental effects because of their increased carbon monoxide emissions. He proposes eliminating sales taxes on smaller automobiles in favor of higher sales taxes levied on SUVs. Al performs some calculations and comes to the conclusion that based on the current number of SUVs owned in the U.S. exactly the same amount of total sales tax will be collected under his reformed system. Which of the following concepts explains why Al's idea may not work?

A) The ability to pay principle

B) Horizontal equity

C) Substitution effect

D) Vertical equity

E) None of the choices are correct

Correct Answer:

Verified

Q65: The substitution effect:

A) predicts that taxpayers will

Q66: Which of the following principles encourages a

Q67: Manny, a single taxpayer, earns $65,000 per

Q68: The concept of tax sufficiency:

A) suggests the

Q69: Which of the following would not be

Q71: If Susie earns $750,000 in taxable income,

Q72: Employers often withhold federal income taxes directly

Q73: Leonardo, who is married but files separately,

Q74: Which of the following is True regarding

Q75: Manny, a single taxpayer, earns $65,000 per

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents