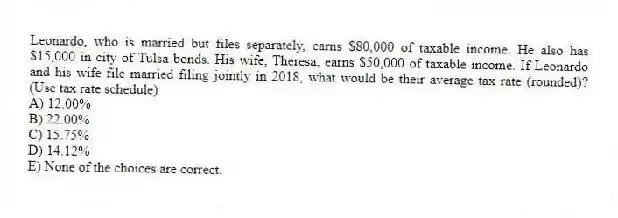

Leonardo, who is married but files separately, earns $80,000 of taxable income. He also has $15,000 in city of Tulsa bonds. His wife, Theresa, earns $50,000 of taxable income. If Leonardo and his wife file married filing jointly in 2018, what would be their average tax rate (rounded) ? (Use tax rate schedule)

A) 12.00%

B) 22.00%

C) 15.75%

D) 14.12%

E) None of the choices are correct.

Correct Answer:

Verified

Q56: Marc, a single taxpayer, earns $60,000 in

Q57: The city of Granby, Colorado recently enacted

Q58: Earmarked taxes are:

A) taxes assessed only on

Q59: Which of the following is a tax?

I.

Q60: Which of the following is True regarding

Q62: Which of the following statements is True?

A)

Q63: Which of the following federal government actions

Q64: Leonardo, who is married but files separately,

Q65: The substitution effect:

A) predicts that taxpayers will

Q66: Which of the following principles encourages a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents