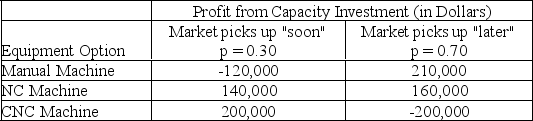

Steve Gentry, the operations manager of Baja Fabricators, wants to purchase a new profiling machine (it cuts compound angles on the ends of large structural pipes used in the fabrication yard). However, because the price of crude oil is depressed, the market for such equipment is down. Steve believes that the market will improve in the near future and that the company should expand its capacity. The table below displays the three equipment options he is currently considering, and the profit he expects each one to yield over a two-year period. The consensus forecast at Baja is that there is about a 30% probability that the market will pick up "soon" (within 3 to 6 months) and a 70% probability that the improvement will come "later" (in 9 to 12 months, perhaps longer).

(a) Calculate the expected monetary value of each decision alternative.

(a) Calculate the expected monetary value of each decision alternative.

(b) Which equipment option should Steve take?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q75: _ is the difference between the payoff

Q76: An operations manager's staff has compiled the

Q77: Describe the meaning of EVPI.

Q78: Which decision rule under uncertainty results in

Q79: Daily sales of bread by Salvador Monella's

Q81: A problem that involves a sequence of

Q82: Earl Shell owns his own Sno-Cone business

Q83: In a decision tree, the expected monetary

Q84: What limitation(s) do decision trees overcome compared

Q85: A toy manufacturer makes stuffed kittens and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents