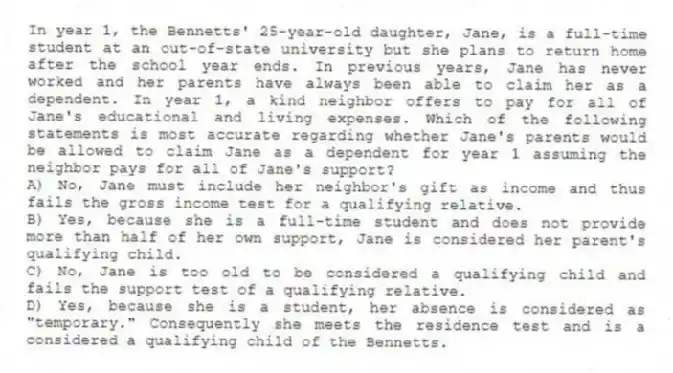

In year 1, the Bennetts' 25-year-old daughter, Jane, is a full-time student at an out-of-state university but she plans to return home after the school year ends. In previous years, Jane has never worked and her parents have always been able to claim her as a dependent. In year 1, a kind neighbor offers to pay for all of Jane's educational and living expenses. Which of the following statements is most accurate regarding whether Jane's parents would be allowed to claim Jane as a dependent for year 1 assuming the neighbor pays for all of Jane's support?

A) No, Jane must include her neighbor's gift as income and thus fails the gross income test for a qualifying relative.

B) Yes, because she is a full-time student and does not provide more than half of her own support, Jane is considered her parent's qualifying child.

C) No, Jane is too old to be considered a qualifying child and fails the support test of a qualifying relative.

D) Yes, because she is a student, her absence is considered as "temporary." Consequently she meets the residence test and is a considered a qualifying child of the Bennetts.

Correct Answer:

Verified

Q58: The income tax base for an individual

Q59: Jeremy and Annie are married. During the

Q60: A taxpayer may qualify for the head

Q61: Which of the following shows the correct

Q62: Which of the following statements regarding tax

Q64: Which of the following statements is True?

A)

Q65: Jamison's gross tax liability is $7,000. Jamison

Q66: Which of the following statements regarding dependents is

Q67: Madison's gross tax liability is $9,000. Madison

Q68: Which of the following relationships does NOT

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents