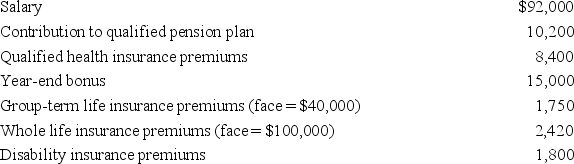

Andres has received the following benefits this year.

Besides these benefits Andres missed work for two months due to an illness. During his illness Andres received $6,500 in sick pay from a disability insurance policy. Assume Andres has disability insurance provided by his employer as a nontaxable fringe benefit. What amount, if any, must Andres include in gross income this year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q120: This year Zach was injured in an

Q121: This fall Angelina, age 35, plans to

Q122: Teresa was married on November 1 of

Q123: Robert will be working overseas on a

Q124: Lisa and Collin are married. Lisa works

Q125: Simon was awarded a scholarship to attend

Q126: Alex is 63 years old and retired.

Q128: Caroline is retired and receives income from

Q129: This year Joseph joined the board of

Q130: Vincent is a writer and U.S. citizen.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents