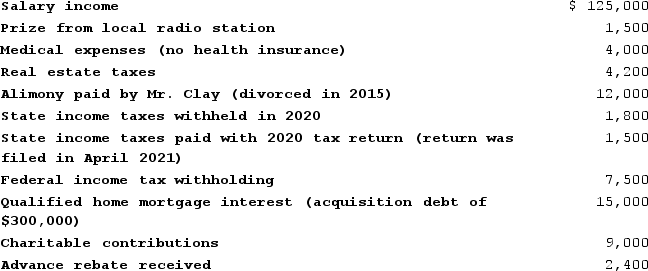

During all of 2020, Mr. and Mrs. Clay lived with their four children (all are under the age of 17). They provided over one-half of the support for each child. Mr. and Mrs. Clay file jointly for 2020. Neither is blind, and both are under age 65. They reported the following tax-related information for the year. (Use the tax rate schedules, 2020 Alternative minimum tax (AMT)exemption)

What are the Clays' taxes payable or refund due? (Ignore the alternative minimum tax.)What are the Clays' tentative minimum tax and alternative minimum tax?

What are the Clays' taxes payable or refund due? (Ignore the alternative minimum tax.)What are the Clays' tentative minimum tax and alternative minimum tax?

Correct Answer:

Verified

Answer computed...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q141: Maria and Tony are married. Assume their

Q147: Lexa, a single taxpayer, worked as an

Q151: Candace is claimed as a dependent on

Q159: Which of the following statements regarding late

Q163: Clarissa's gross tax liability for 2020 is

Q165: Johann had a gross tax liability of

Q166: During all of 2020, Mr. and Mrs.

Q170: Assume Georgianne underpaid her estimated tax liability

Q175: Assume Georgianne underpaid her estimated tax liability

Q176: Julien and Sarah are married, file a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents