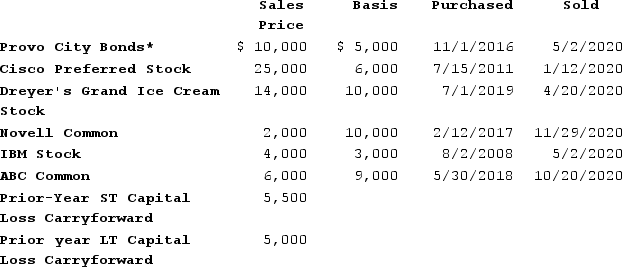

Scott Bean is a computer programmer and incurred the following transactions last year.

*Purchased when originally issued by Provo City.

*Purchased when originally issued by Provo City.

What is the net short-term capital gain/loss reported on the 2020 Schedule D? What is the net long-term capital gain/loss reported on the 2020 Schedule D? What amount of capital gain is subject to the preferential capital gains rate?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q63: On January 1, 20X1, Fred purchased a

Q64: Henry, a single taxpayer with a marginal

Q65: On the sale of a passive activity,

Q66: Scott Bean is a computer programmer and

Q67: Michelle is an active participant in the

Q70: Sarantuya, a college student, feels that now

Q72: On December 1, 20X7, George Jimenez needed

Q73: On December 1, 20X7, George Jimenez needed

Q74: Mr. and Mrs. Smith purchased 115 shares

Q79: What is the tax treatment for qualified

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents