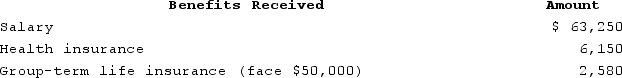

Frank received the following benefits from his employer this year. What amount must Frank include in his gross income?

A) $63,250

B) $69,400

C) $65,830

D) $71,980

E) $0 - these benefits are excluded from gross income

Correct Answer:

Verified

Q85: Charles and Camillagot divorced in 2018. Under

Q91: Janine's employer loaned her $5,000 this year

Q96: Bernie is a former executive who is

Q99: Mike received the following interest payments this

Q100: Hal Gore won a $1.75 million prize

Q104: Helen is a U.S. citizen and a

Q105: Brenda has $15,000 in U.S. Series EE

Q106: Ben received the following benefits from his

Q107: This year Zach was injured in an

Q112: NeNe is an accountant and a U.S.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents