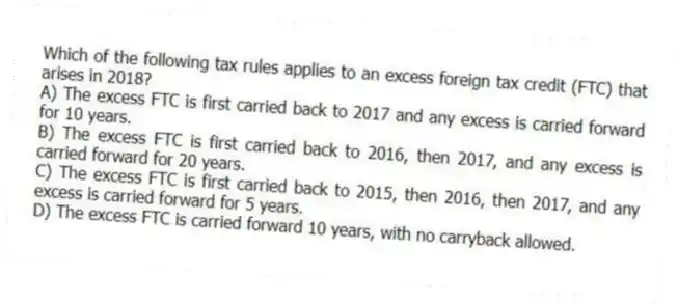

Which of the following tax rules applies to an excess foreign tax credit (FTC) that arises in 2018?

A) The excess FTC is first carried back to 2017 and any excess is carried forward for 10 years.

B) The excess FTC is first carried back to 2016, then 2017, and any excess is carried forward for 20 years.

C) The excess FTC is first carried back to 2015, then 2016, then 2017, and any excess is carried forward for 5 years.

D) The excess FTC is carried forward 10 years, with no carryback allowed.

Correct Answer:

Verified

Q46: Hanover Corporation, a U.S. corporation, incurred $300,000

Q49: Which of the following expenses incurred by

Q50: Which of the following is not a

Q51: Bismarck Corporation has a precredit U.S. tax

Q53: Absent a treaty provision, what is the

Q54: Manchester Corporation, a U.S. corporation, incurred $100,000

Q57: A U.S. corporation reports its foreign tax

Q66: Which of the following tax benefits does

Q68: What form is used by a U.S.

Q75: A rectangle with a triangle within it

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents