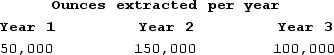

Lucky Strike Mine (LLC) purchased a silver deposit for $1,500,000. It estimated it would extract 500,000 ounces of silver from the deposit. Lucky Strike mined the silver and sold it, reporting gross receipts of $1.8 million, $2.5 million, and $2 million for Years 1 through 3, respectively. During Years 1 through 3, Lucky Strike reported net income (loss) from the silver deposit activity in the amount of ($100,000) , $400,000, and $100,000, respectively. In Years 1 through 3, Lucky Strike actually extracted 300,000 ounces of silver as follows:  What is Lucky Strike's depletion deduction for Year 2 if the applicable percentage depletion for silver is 15 percent?

What is Lucky Strike's depletion deduction for Year 2 if the applicable percentage depletion for silver is 15 percent?

A) $200,000

B) $375,000

C) $400,000

D) $450,000

E) None of the choices are correct.

ESSAY. Write your answer in the space provided or on a separate sheet of paper.

98) Janey purchased machinery on April 8 th of the current year. The relevant costs for the year are as follows: machinery for $10,000, $800 shipping, $50 for delivery insurance, $500 for installation, $750 for sales tax, $150 for the annual tune-up, and $200 of property taxes (an annual tax on business property) . What is Janey's tax basis for the machinery?

Correct Answer:

Verified

Q53: Which depreciation convention is the general rule

Q60: Crouch LLC placed in service on May

Q67: Bonnie Jo purchased a used camera (five-year

Q77: Which of the following assets is not

Q88: Santa Fe purchased the rights to extract

Q89: Gessner LLC patented a process it developed

Q91: Daschle LLC completed some research and development

Q92: Jasmine started a new business in the

Q98: Jasmine started a new business in the

Q100: Jorge purchased a copyright for use in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents