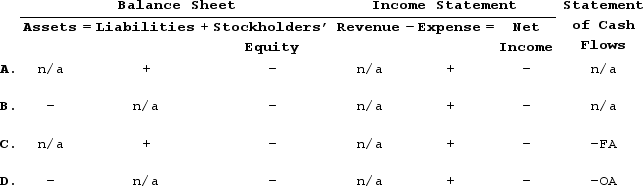

Mr. Ortega earns a monthly salary of $4,000. Based on Mr. Ortega's Form W-4, the tax tables require withholding $450 per month for income taxes. Mr. Ortega has authorized his employer to deduct $190 per month for medical insurance and $15 per month for a charitable contribution to the Humane Society. Assume a FICA tax rate of 6%, a Medicare tax rate of 1.5%, and an Unemployment tax rate of 6% on the first $7,000 of income. Which of the following shows how recognizing the accrued payroll tax expense would affect the employer's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q23: What factor distinguishes an employee from an

Q28: Which of the following is not an

Q73: Which of the following is responsible for

Q75: The following information is taken from the

Q77: The following information is taken from the

Q79: Which of the following would not likely

Q80: Mr. Ortega earns a monthly salary of

Q81: Seattle Company issued a $90,000 face value

Q82: On October 1, Year 1, Hartford Company

Q83: Baltimore Company issued a $9,000 face value

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents