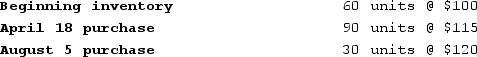

During December Year 2, Crowe Company sold 125 units @ $225 each. Cash selling and administrative expenses for the year were $11,000. All transactions were cash transactions. The following information is also available:

The company's income tax rate is 30%.

The company's income tax rate is 30%.

Required:a)Prepare an income statement for Crowe Company for Year 2 assuming:1)FIFO inventory cost flow2)LIFO inventory cost flowb)Prepare the operating activities section of the statement of cash flows for Year 2 assuming:1)FIFO inventory cost flow 2)LIFO inventory cost flow

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Discuss the significance of the average number

Q142: The following transactions apply to Sam's Skateboards.

Q143: On February 2, Year 2, a fire

Q144: Singh Company sold 75 units @ $350

Q145: The following information is for Choi Company

Q146: Max Company's first year in operation was

Q148: What ratio (usually an average from prior

Q150: Indicate whether each of the following statements

Q151: Curtis Company had the following transactions for

Q152: Maynard Company started the year with no

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents