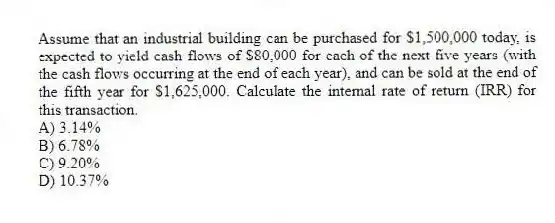

Assume that an industrial building can be purchased for $1,500,000 today, is expected to yield cash flows of $80,000 for each of the next five years (with the cash flows occurring at the end of each year) , and can be sold at the end of the fifth year for $1,625,000. Calculate the internal rate of return (IRR) for this transaction.

A) 3.14%

B) 6.78%

C) 9.20%

D) 10.37%

Correct Answer:

Verified

Q8: The Real Estate Research Corporation (RERC) regularly

Q9: Suppose an investor deposits $2500 in an

Q10: Since investors prefer to have money now

Q11: Suppose that a landlord is interested in

Q12: Assuming that an investor requires a 10%

Q14: With compound interest, the investor earns interest

Q15: An investor agreed to sell a warehouse

Q16: Assume that an individual puts $10,000 into

Q17: Assuming all else the same, the _

Q18: When discussing time-value-of-money it is necessary to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents