Multiple Choice

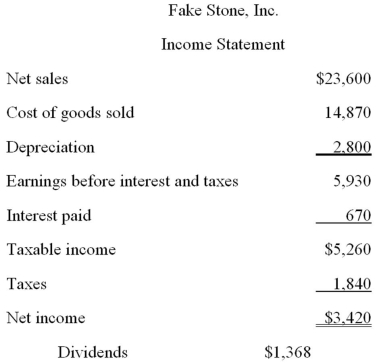

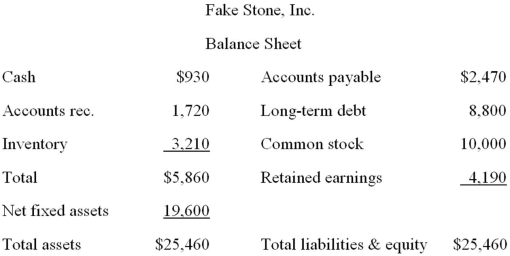

Assume that Fake Stone, Inc.is operating at 88 percent of capacity.All costs and net working capital vary directly with sales.What is the amount of the pro forma net fixed assets for next year if sales are projected to increase by 13 percent?

A) $19,600

B) $20,406

C) $21,500

D) $21,667

E) $22,148

Correct Answer:

Verified

Related Questions