Multiple Choice

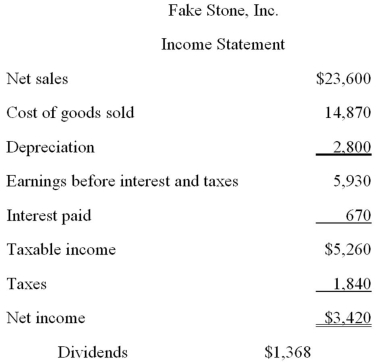

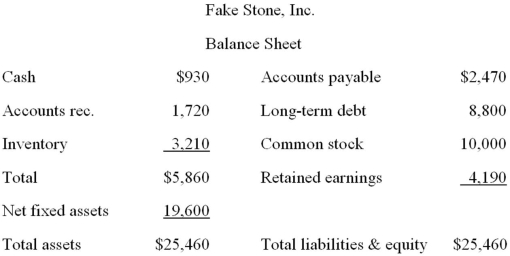

Assume that Fake Stone, Inc.is operating at full capacity.Also assume that assets, costs, and current liabilities vary directly with sales.The dividend payout ratio is constant.What is the external financing need if sales increase by 12 percent?

A) -$318.09

B) -$268.49

C) $103.13

D) $350.40

E) $460.56

Correct Answer:

Verified

Related Questions