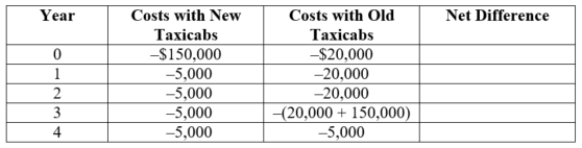

(Table: Taxi Fleet) Metro Cab is considering replacement of its fleet of old taxicabs. To replace its fleet, Metro must spend $150,000 on new taxicabs. The new taxis will incur $5,000 of maintenance expenses per year. Alternatively, Metro could spend $20,000 today to refurbish its taxicabs and incur an additional $20,000 per year of maintenance expenses for the next three years. Metro would then have to buy new taxicabs for $150,000 at the end of three years, leading to lower maintenance expenses of $5,000 per year.  Using an interest rate of 20%, the net present value of the first three years is $____.

Using an interest rate of 20%, the net present value of the first three years is $____.

A) 65,000

B) 32,000

C) 20,000

D) -34,509

Correct Answer:

Verified

Q23: Using the Rule of 72, how many

Q24: Suppose that a firm generates $40,000 of

Q25: Sam is considering the purchase of a

Q26: Sam is considering the purchase of a

Q27: Jerome operates a car repair shop and

Q29: (Table: Total Utility II) Q30: Let π = inflation rate, r = Q31: (Table: Payback Period) Q32: Assume a future payment of $10,000. Q33: In the market for capital, the discovery![]()

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents