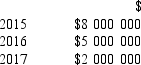

On 1 January 2015, Romulus Ltd signed a contract worth $21 000 000 to construct a light rail from A to B. The light rail was to be built over three years, with progress payments of $7 000 000 to be made at the end of each year. Estimated costs were $15 000 000 and the following costs incurred and paid by Romulus Ltd were in accordance with estimates and represented the percentage completed in each year:

The project was completed in December 2017. Using the percentage of completion method, what profit would Romulus Ltd report in 2015?

A) $800 000

B) $2 000 000

C) $3 200 000

D) $1 300 000

Correct Answer:

Verified

Q4: Revenue should be recognised when: Q7: Multi-Storey Builders Ltd had a large three-year Q10: Highrise Constructions Ltd had a large three-year Q10: Highrise Constructions Ltd had a large three-year Q12: Which of the following transactions should not Q13: Highrise Constructions Ltd had a large three-year Q14: Highrise Constructions Ltd had a large three-year Q17: Multi-Storey Builders Ltd had a large three-year Q17: Although revenue may be recognised at various Q19: Which of the following is NOT necessary![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents