The Tearess Company can accept either Proposal A or Proposal B (but not both), or it can reject both investment proposals. Proposal A requires an investment of $7000 and promises increased net cash inflows of $2600 for five years. Proposal B requires an investment of $7000 and promises increased net cash inflows of $3000 in each of the first three years, $2000 in the fourth year and $2200 in the fifth year. The company's minimum acceptable rate of return is 20%.

Prepare an analysis to determine which (if either) of the proposals should be selected for investment.

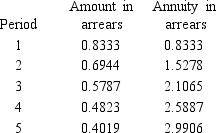

Discount factors for 20%:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q37: Guerdon Ltd is reviewing a project that

Q38: The Orgonne Milling Company is contemplating the

Q39: Which of the methods of evaluating capital

Q40: Companies evaluating capital investment projects frequently use

Q41: A business is for sale at $100

Q43: You have an opportunity to purchase the

Q44: Describe the accounting rate of return (ARR)

Q45: Earning interest in one period on interest

Q46: Which of the following combinations of interest

Q47: If you placed $1000 in a savings

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents