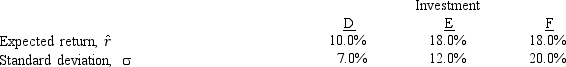

Based on the information given below, which of the investments would be considered best based on its risk and return relationship? Assume all investors are risk-averse and the investments will be held in isolation, not in a portfolio.

A) D, because its total risk is lowest.

B) E, because its coefficient of variation is lowest.

C) F, because its standard deviation, , is highest.

D) E and F, because they have the same expected return,.

E) None of the above.

Correct Answer:

Verified

Q51: Assume you are considering combining two investments

Q51: Sharon Stonewall currently has an investment

Q52: Which of the following statements is

Q53: Based on the information given below, which

Q55: Calculate the standard deviation of the expected

Q57: Assume the risk-free rate of return

Q58: Share Q has a beta (

Q59: Share X has (

Q60: HR Corporation has a beta of 2.0,

Q61: CAPM Analysis

You have been asked to use

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents