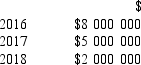

On 1 January 2016, Romulus Ltd signed a contract worth $21 000 000 to construct a light rail from A to B. The light rail was to be built over three years, with progress payments of $7 000 000 to be made at the end of each year. Estimated costs were $15 000 000 and the following costs incurred and paid by Romulus Ltd were in accordance with estimates and represented the percentage completed in each year:  The project was completed in December 2018. Using the percentage of completion method, what profit would Romulus Ltd report in 2016?

The project was completed in December 2018. Using the percentage of completion method, what profit would Romulus Ltd report in 2016?

A) $800 000

B) $2 000 000

C) $3 200 000

D) None of the above

Correct Answer:

Verified

Q10: Highrise Constructions Ltd had a large three-year

Q11: Under which of the following circumstances would

Q12: At what point would you expect revenue

Q13: Highrise Constructions Ltd had a large three-year

Q14: Which of the following transactions should not

Q16: The profit for a particular project of

Q17: Although revenue may be recognised at various

Q18: Multi-Storey Builders Ltd had a large three-year

Q19: Revenue recognition means that:

A) revenue is not

Q20: On 1 January 2016, Romulus Ltd signed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents