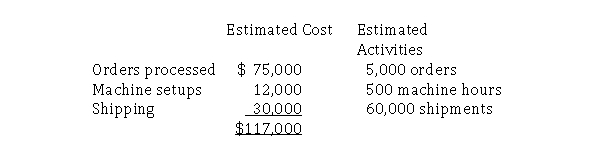

Jones Manufacturing Company makes two products.In the past, the company allocated overhead based on estimated total direct labor hours of 20,000.Jones recently implemented an activity-based costing system and had determined that overhead can be broken into three overhead pools: processed purchase orders, machine setups, and good shipped.The following is a summary of company information:  Required:

Required:

a.Calculate the company's overhead rate using a single cost pool.

b.Calculate the company's overhead rates using the activity-based costing pools.

Correct Answer:

Verified

Q153: Clover Manufacturing Company makes two products.Using the

Q154: Identify the following activities in a medical

Q155: A&W Manufacturing has implemented an activity-based costing

Q156: Place and "X" in the column that

Q157: Costs of cleaning service

Required:

Identify at least one

Q159: Delivery of goods to customer job sites

Required:

Identify

Q160: Place an "x" in the column that

Q161: Camilla, Inc.uses activity-based costing to cost its

Q162: The following list includes activities that are

Q163: Assume you have been hired by a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents