The following information relates to Questions 1-10

Samuel & Sons is a fixed-income specialty firm that offers advisory services to investment management companies. on 1 october 20X0, Steele ferguson, a senior analyst at Samuel, is reviewing three fixed-rate bonds issued by a local firm, Pro Star, inc. The three bonds, whose characteristics are given in Exhibit 1, carry the highest credit rating.

EXHiBiT 1 fixed-Rate Bonds issued by Pro Star, inc.

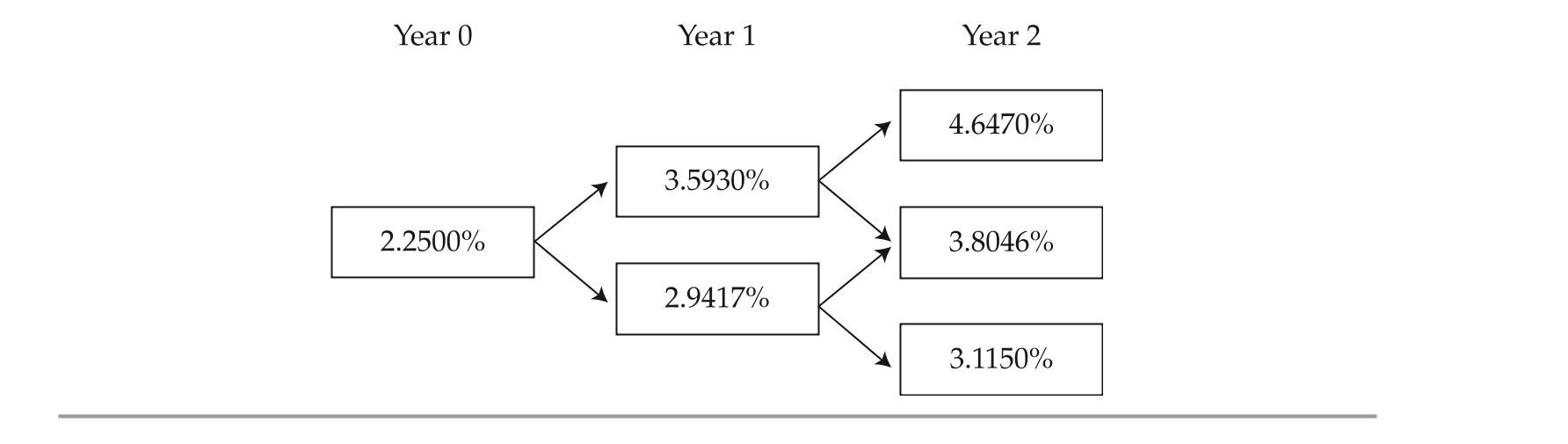

The one-year, two-year, and three-year par rates are 2.250%, 2.750%, and 3.100%, re-spectively. Based on an estimated interest rate volatility of 10%, ferguson constructs the bino-mial interest rate tree shown in Exhibit 2.

EXHiBiT 2 Binomial interest Rate Tree

on 19 october 20X0, ferguson analyzes the convertible bond issued by Pro Star given in Exhibit 3. That day, the option-free value of Pro Star's convertible bond is $1,060 and Pro Star's stock price is $37.50.

on 19 october 20X0, ferguson analyzes the convertible bond issued by Pro Star given in Exhibit 3. That day, the option-free value of Pro Star's convertible bond is $1,060 and Pro Star's stock price is $37.50.

EXHiBiT 3 Convertible Bond issued by Pro Star, inc.

-A fall in interest rates would most likely result in:

A) a decrease in the effective duration of Bond 3.

B) Bond 3 having more upside potential than Bond 2.

C) a change in the effective convexity of Bond 3 from positive to negative.

Correct Answer:

Verified

Q3: The following information relates to Questions

Q4: The following information relates to Questions

Q5: The following information relates to Questions

Q6: The following information relates to Questions

Q7: The following information relates to Questions

Q9: The following information relates to Questions

Q10: The following information relates to Questions

Q11: The following information relates to Questions

Q12: The following information relates to Questions

Q13: The following information relates to Questions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents