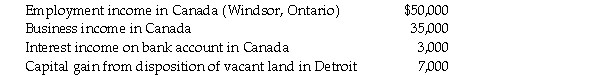

Kenichi Takahawa is a resident of the United States, living in Detroit, Michigan. He works and earns income for the year as follows:  What is his Canadian Net Income For Tax Purposes under Part I of the Income Tax Act?

What is his Canadian Net Income For Tax Purposes under Part I of the Income Tax Act?

A) $50,000

B) $85,000

C) $88,000

D) $91,500

Correct Answer:

Verified

Q25: An entity would be a controlled foreign

Q26: In which of the following cases, where

Q27: Darren Brock, a non-resident, borrows $422,000 and

Q28: In general, if a non-resident earns income

Q29: Under the Canada/U.S. tax treaty, if a

Q31: If a U.S. corporation owns a storage

Q32: Fahad Lodhi is a resident of the

Q33: Many types of income are subject to

Q34: Merivale is an American corporation with operations

Q35: Which of the following businesses will be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents