Ian Home has a property that he purchased several years ago for $20,000. It has a current fair market value of $30,000.

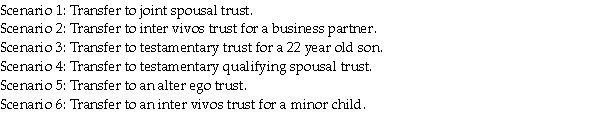

The following Six Scenarios are proposed for the transfer of this property by Ian to a trust. For each Scenario, indicate the tax consequences to Ian at the time of transfer, as well as the adjusted cost base of the property within the trust.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q67: Which of the following is NOT a

Q68: The Ali family trust was established when

Q69: What is the objective of an estate

Q70: Monique Flaharty has accumulated securities that earn

Q71: At the beginning of 2020, Martha Stuart

Q73: Five years ago, a depreciable asset was

Q74: Larry died during 2020 and bequeathed a

Q75: On January 1, 2020 , Jerry Fallen

Q76: Martine Flex died three years ago. At

Q77: In each of the following Cases, an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents