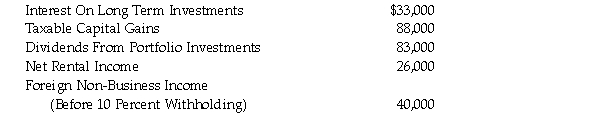

Elm Inc. is a Canadian controlled private corporation. During the taxation year ending December 31, 2020, the Company has the following amounts of property income:  The Company's 2020 Net Income For Tax Purposes is $458,000. In calculating Taxable Income, the Company deducted a $45,000 net capital loss carry forward.

The Company's 2020 Net Income For Tax Purposes is $458,000. In calculating Taxable Income, the Company deducted a $45,000 net capital loss carry forward.

In calculating Tax Payable, the Company deducted a small business deduction of $23,750 and a foreign non-business tax credit of $4,000. The Tax Payable has been correctly determined to be $71,607.

Determine the refundable amount of Part I tax for the year ending December 31, 2020.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q60: Opus Limited is a Canadian controlled private

Q61: With respect to GRIP and LRIP balances,

Q62: Marion Fox has investments that generate interest

Q63: At the end of 2019, Gomez Inc.,

Q64: Starfare Ltd. is a Canadian controlled private

Q66: Barnum Ltd. is a CCPC with a

Q67: Saxon Company is a CCPC that began

Q68: Axco Inc. is a CCPC with a

Q69: Patrick Innes has a business that he

Q70: Blackwood Inc. is a Canadian controlled private

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents