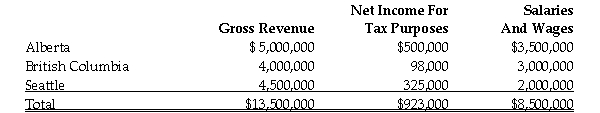

Calgary Corporation has permanent establishments in Alberta, British Columbia and Seattle in the United States. Gross revenues, Net Income and salaries and wages for each permanent establishment are:  For the purposes of calculating the federal tax abatement, the percentage of income allocated to a Canadian province would be:

For the purposes of calculating the federal tax abatement, the percentage of income allocated to a Canadian province would be:

A) 64.79%.

B) 65.72%.

C) 70.63%.

D) 71.57%.

Correct Answer:

Verified

Q19: Because they expire after 20 years, non-capital

Q20: For a corporation, dividends received from other

Q21: A Specified Investment Business is a business

Q22: When dividends are paid by one taxable

Q23: Ottawa Corporation has accounting income for the

Q25: If a corporation is classified as a

Q26: The two variables used to allocate income

Q28: CCC Inc. is a Canadian controlled private

Q29: A corporation's Net Income For Tax Purposes

Q53: The base used for calculating the M&P

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents