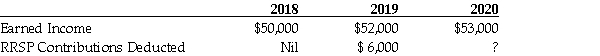

Mrs. Jacks is employed by RME Industries Ltd. RME Industries Ltd. does not offer a Registered Pension Plan or a Deferred Profit Sharing Plan to its employees. She has no Earned Income prior to 2018. Given the following, what is the maximum RRSP contribution that Mrs. Jacks can deduct for the 2020 taxation year?

A) $9,000.

B) $9,360.

C) $12,000.

D) $12,360.

E) None of the above.

Correct Answer:

Verified

Q53: Which of the following statements about Lifelong

Q54: During the year ending December 31, 2019,

Q55: On April 1, 2019 Mrs. Wu contributed

Q56: During the year ending December 31, 2019,

Q57: Yukie has net employment income of $35,000.

Q59: Mehrdad contributed $10,000 to an RRSP ten

Q60: Which of the following statements with respect

Q61: Mr. Marco Marconi has net employment income

Q62: For 2019, Andrew Flack has Earned Income

Q63: On January 1, 2020 Mr. Yang celebrated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents