In order to supplement his income working in a Calgary bookstore, Mr. Victor Larson has decided to start a home based business that will specialize in selling used textbooks to university and college students.

The business will be run out of space that he has set aside in his residence. This space involves 18 percent of the total floor space in the residence.

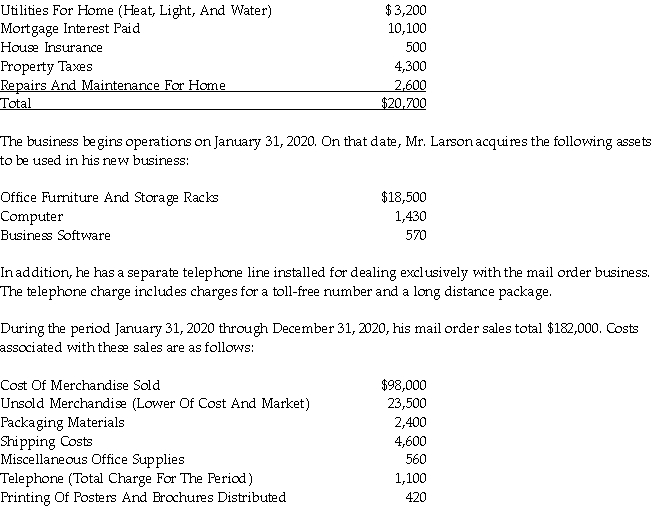

The residence was acquired on January 1, 2020 at a total cost of $426,000. It is estimated that $150,000 of this total value can be attributed to the land on which the residence is situated. For the year ending December 31, 2020, Mr. Larson has the following costs that can be associated with this residence:  Required:

Required:

A. Can Mr. Larson deduct work space in the home costs? Briefly explain your conclusion.

B. Compute the minimum net business income or loss that Mr. Larson must report in his 2020 personal income tax return.

C. Briefly describe any issues that should be discussed with Mr. Larson concerning the work space in his home and business costs.

Correct Answer:

Verified

Under ITA 18(12), the following c...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q93: Frank's Auto Body, an unincorporated business, keeps

Q94: In January, 2020, Marty's Fine Pens sells

Q95: On January 1, 2019, a new Canadian

Q96: During 2020, Leslie's Boutique wrote off $13,000

Q97: Ms. Joan Vickers is an accountant and,

Q98: Mr. Brian Brock is selling his unincorporated

Q99: Morton Enterprises sells a single product which

Q100: For a number of years, Ms. Alexandria

Q101: Coretta Kirkman is the sole proprietor of

Q103: Ms. Brooke Besson is selling her unincorporated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents