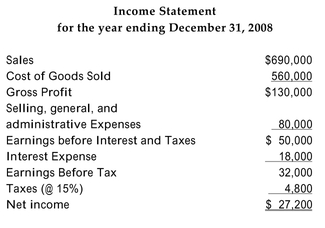

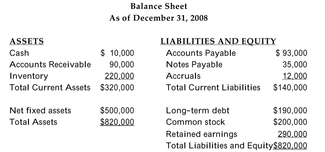

The 2008 financial statements for Carmela's Catering are as follows:

The firm has 100,000 shares of common stock outstanding with a market value of $8 a share.

The firm has 100,000 shares of common stock outstanding with a market value of $8 a share.

-Refer to the information above. The cost of Carmela's debt capital is 8%. The market beta of the firm's equity is 1.4. The relevant risk-free rate is 4% and the expected return on the market

Portfolio is 10%. Calculate Carmela's weighted average cost of capital.

A) 11.4%

B) 9.0%

C) 12.4%

D) 15.8%

Correct Answer:

Verified

Q1: All else equal, if a firm buys

Q2: The 2008 financial statements for Carmela's Catering

Q3: The liabilities-to-equity ratio for a firm is

Q4: The 2008 financial statements for Carmela's Catering

Q6: The 2008 financial statements for Carmela's Catering

Q7: The liabilities-to-equity ratio for a firm is

Q8: Which of the following will result in

Q9: An argument for using the book value

Q10: The 2008 financial statements for Carmela's Catering

Q11: Which of the following would result in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents