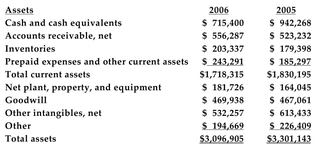

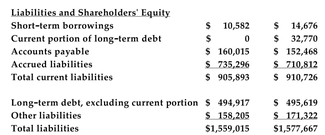

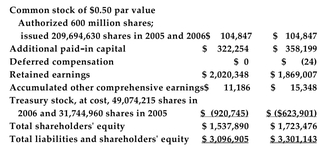

Below are 2005 and 2006 balance sheets of Hasbro, Inc. (numbers are in thousands of dollars) :

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

-Refer to the information above. What was Hasbro's liabilities-to-assets ratio, based on market value of the assets in 2006?

A) 55.3%

B) 29.3%

C) 50.3%

D) 17.9%

Correct Answer:

Verified

Q36: A zero-coupon, convertible bond promises to pay

Q37: Preferred stock is like a bond in

Q38: Which of the following is classified as

Q39: What are the advantages and disadvantages associated

Q40: Which of the following statements regarding preferred

Q42: The following information has been collected from

Q43: The following information has been collected from

Q44: Below are 2005 and 2006 balance sheets

Q45: Below are 2005 and 2006 balance sheets

Q46: Below are 2005 and 2006 balance sheets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents