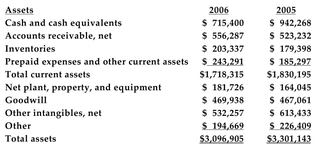

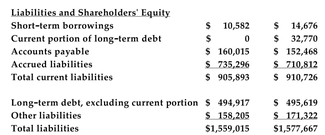

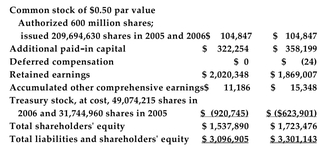

Below are 2005 and 2006 balance sheets of Hasbro, Inc. (numbers are in thousands of dollars) :

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

-Refer to the information above. Hasbro's financial debt-to-capital book value ratio in 2006 was

A) 24.3%.

B) 24.7%.

C) 50.3%.

D) none of the above.

Correct Answer:

Verified

Q51: Calculate the 2006 financial debt-to-financial capital ratios

Q52: Which of the following statements about IBM's

Q53: The following information has been collected from

Q54: A firm has 800 million authorized shares,

Q55: Below are 2005 and 2006 balance sheets

Q56: The following information has been collected from

Q57: The following information has been collected from

Q58: A firm has 500 million authorized shares,

Q59: Most of the change in IBM's capital

Q61: How might the financial debt-to-assets ratio be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents