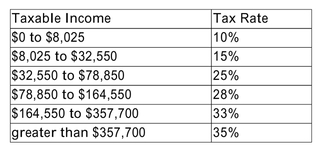

In 2008, the tax schedule for a single taxpayer is as follows:  The tax rate for capital gains and dividend income is 15% for investors in marginal tax brackets greater than 15%. Paul invested $10,000 in the stock market and $10,000 in bonds. During the

The tax rate for capital gains and dividend income is 15% for investors in marginal tax brackets greater than 15%. Paul invested $10,000 in the stock market and $10,000 in bonds. During the

Year Paul earned $1,000 in dividends and $900 in interest income from these investments. If

Paul is in the 28% marginal tax bracket, what was his tax obligation on the income from his

Portfolio?

A) $285

B) $532

C) $402

D) None of the above is a correct answer.

Correct Answer:

Verified

Q30: An individual has earnings of $80,000 and

Q31: Hong Jun invested $10,000 in the stock

Q32: Which of the following statements about municipal

Q33: You purchased a house for $450,000 and

Q34: Assume you bought a $400,000 house, using

Q36: Jackie earns $5,000 a month in taxable

Q37: An "on-the-run" Treasury security

A)will command a higher

Q38: A taxable corporate bond is yielding 8%

Q39: A municipal bond is yielding 7% and

Q40: You purchased 100 shares of Amazon.com (AMZN)for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents