The following information pertains to questions

X purchased 30% of Y of Y on January 1,2002 for $300,000.On the date,Y's net assets of Y had a book value of $500,000.Any Acquisition Differential on the acquisition date is to be allocated to Y's Equipment,which had a remaining useful life of 5 years from the date of acquisition.Y paid dividends of $20,000 in each year.

Y's income statements for 2002 and 2003 showed the following:

-On January 1,2004,Black Corporation purchased 15 per cent of the outstanding shares of White Corporation for $498,000.From Black's perspective,White was a FVTPL investment.The fair value of Black's investment was $520,000 at December 31,2004.

On January 1,2005,Black purchased an additional 30 per cent of White's shares for $750,000.The second share purchase allows Black to exert significant influence over White There was an acquisition differential of 30 per cent on the date of acquisition.

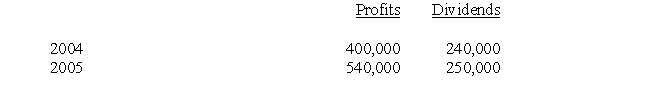

During the two years White reported the following results:

Required:

With respect to this investment,prepare Black's journal entries for both 2004 and 2005.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q48: The following information pertains to questions

Jones

Q49: Telnor Corporation (whose year end is December

Q50: If the Investor sells part of its

Q51: How is an Associate's Income from non-operating

Q52: Dragon Corporation acquired a 7% interest in

Q54: Prepare X's journal entries for 2002 and

Q55: On January 1,2002,James Inc.paid $500,000 to purchase

Q56: Ronen Corporation owns 35% of the outstanding

Q57: The following information pertains to questions

Jones

Q58: On January 1,2002,Jonson Inc.paid $400,000 to purchase

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents