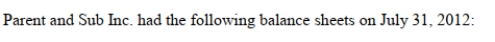

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assume that Parent Inc. purchased a controlling interest in Sub Inc. on August 1, 2012 and decides to prepare an Income Statement for the combined entity on the date of acquisition. If Parent acquired 100% of Sub Inc. on that date, what would be the net income reported for the combined entity (for the year ended July 31, 2012) ?

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assume that Parent Inc. purchased a controlling interest in Sub Inc. on August 1, 2012 and decides to prepare an Income Statement for the combined entity on the date of acquisition. If Parent acquired 100% of Sub Inc. on that date, what would be the net income reported for the combined entity (for the year ended July 31, 2012) ?

A) $60,000

B) $120,000

C) $180,000

D) Nil

Correct Answer:

Verified

Q6: Contingent consideration should be valued at:

A) the

Q13: Under the Parent Company Theory, which of

Q14: Q15: On the date of acquisition, consolidated shareholders' Q15: When the parent forms a new subsidiary: Q16: A company owning a majority (but less Q19: Q21: Non-Controlling Interest is presented under the Liabilities Q22: Non-Controlling Interest is presented in the Shareholders' Q23: Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

A)![]()

![]()