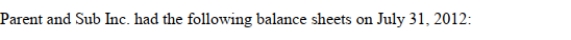

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assume that Parent Inc. purchased a controlling interest in Sub Inc. on August 1, 2012 and decides to prepare an Income Statement for the combined entity on the date of acquisition. If Parent acquired 80% of Sub Inc. on that date, what would be the net income reported for the combined entity (for the year ended July 31, 2012) ?

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assume that Parent Inc. purchased a controlling interest in Sub Inc. on August 1, 2012 and decides to prepare an Income Statement for the combined entity on the date of acquisition. If Parent acquired 80% of Sub Inc. on that date, what would be the net income reported for the combined entity (for the year ended July 31, 2012) ?

A) $104,000

B) $120,000

C) $130,000

D) Nil

Correct Answer:

Verified

Q3: Contingent consideration will be classified as a

Q6: When preparing the consolidated balance sheet on

Q6: On the date of formation of a

Q7: The purchase price of an entity includes:

A)

Q8: One weakness associated with the Entity Theory

Q12: Under the Proprietary theory, Non-Controlling Interest is:

A)

Q13: Under the Parent Company Theory, which of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents