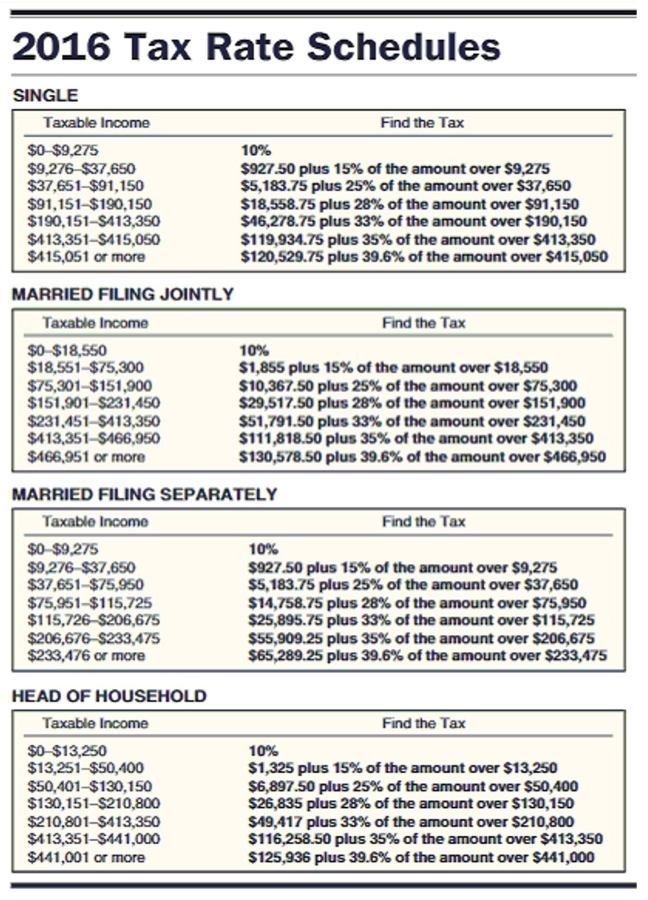

Find the tax in the following application problems. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, $6300 for married taxpayers filing separately, and $9300 for head of household and the tax rate schedule.

-Glenn and Natalie Dowling had combined wages and salaries of $69,117, other income of $5,258, dividend income of $317, and interest income of $664. They have adjustments to income of $2,435. Their itemized deductions are $9,180 in mortgage interest, $1,611 in state income tax, $846 in real estate taxes, and $1,193 in charitable contributions. The Dowlings filed a joint return and claimed four exemptions.

A) $4,243.65

B) $8,772.75

C) $6,128.15

D) $5,656.15

Correct Answer:

Verified

Q50: Find the indicated premium. Round to the

Q51: Solve the problem.

-A taxpayer's property has a

Q52: Find the indicated tax rate. Q53: Find the amount paid by each of Q54: Find the total annual premium. Use the Q56: Find the amount paid by each insurance Q57: Find the tax refund or tax due Q58: Find the tax in the following application Q59: Solve the problem. Q60: Find the property tax. Round to

-![]()

-A driver injures a bicycle

-Assessed Tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents