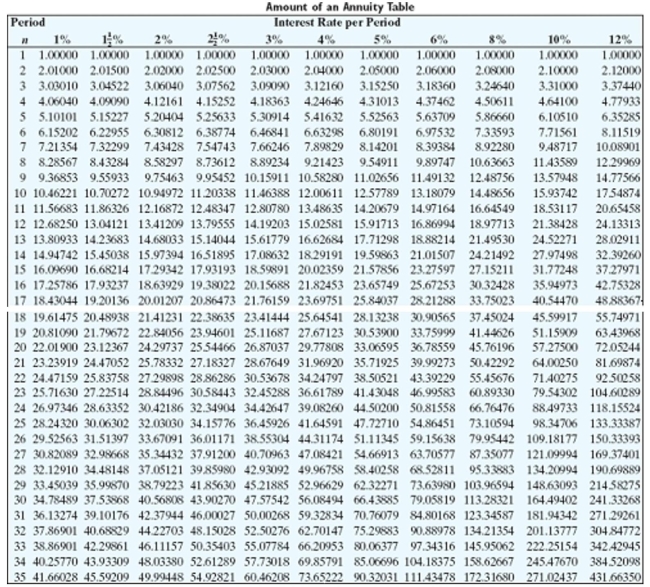

Solve the problem. Refer to the table if necessary.

-Greg plans to contribute $500 per year to a retirement plan and is debating the use of a certificate of deposit that pays 2% per year versus a stock fund that he believes will yield 6% per year. Find the future value after 15 years of the CD and the stock fund.

A) CD: $8,646.71

Stock fund: $11,637.99

B) CD: $8,646.71

Stock fund: $13,576.06

C) CD: $7,986.97

Stock fund: $11,637.99

D) CD: $8,341.07

Stock fund: $10,789.28

Correct Answer:

Verified

Q63: Solve the problem. Refer to the table

Q64: Find the amount of the annuity due

Q65: Find the requested value using the given

Q66: Find the amount of the annuity due

Q67: Find the amount of the ordinary annuity

Q68: Find the requested value using the given

Q69: Find the PE ratio. Round to the

Q70: Use the given bond table to find

Q71: Find the present value of the annuity.

Q73: Stock prices on consecutive days for a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents