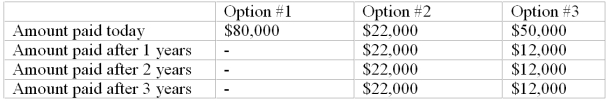

Suppose that you have a winning lottery ticket for $100,000. The State of California doesn't pay this amount up front - this is the amount you will receive over time. The State offers you two options. The first pays you $80,000 up front and that will be the entire amount. The second pays you winnings over a three year period. The last option pays you a large payment today with

small payments in the future. The payment options are detailed in the table below:

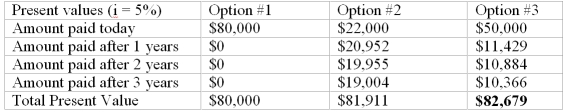

Compute the present value of each payment option, assuming the interest rate is 12%. Now, compute the present values based on an interest rate of 5%. Compare your answers, explaining why they are different when the interest rate changes. When the interest rate is 5%, the present values are as follows:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q87: Convert each of the following basis points

Q88: A lender expects to earn a real

Q89: What is the monthly interest rate if

Q90: Calculate which has a higher present value:

Q91: From the Fisher equation we see that

Q93: A bond offers a $50 coupon, has

Q94: Using the rule of 72, determine the

Q95: Compute the interest rate for a $1,000

Q96: What will be the amount owed at

Q97: If a lender wants to earn a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents