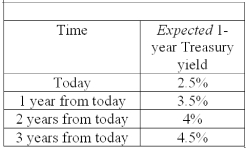

Using the information provided and the expectations hypothesis, compute the yields for a two-year, three-year, and four-year bonds.

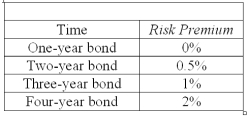

Now, suppose there is a risk premium attached to each bond. These risk premiums are given in the table below:

Using the information above and the liquidity premium theory, compute the yields for a two- year, three-year, and four-year bonds. How does this yield curve compare to the one you computed using the expectations hypothesis?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q111: Why do yield curves usually slope upward?

Q112: What impact should an economic slowdown have

Q113: Describe the concept of flight to quality

Q114: Why can't the expectations hypothesis stand alone

Q115: How did asset backed commercial paper (ABCP)

Q117: What is meant by a subprime mortgage?

Q118: If an investor wants to compare commercial

Q119: What is the effective after-tax yield to

Q120: Assuming the expectations hypothesis is correct, and

Q121: Under the expectations hypothesis of the term

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents