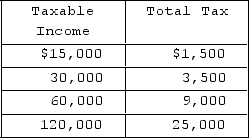

The table represents a personal income tax schedule. The average tax rate at the $60,000 level of income is

The table represents a personal income tax schedule. The average tax rate at the $60,000 level of income is

A) 10.0 percent.

B) 11.6 percent.

C) 15.0 percent.

D) 20.8 percent.

Correct Answer:

Verified

Q219: From 1960 to 2018, government purchases as

Q220: The so-called Tax Freedom Day of each

Q221: Which of the following is the most

Q222: Many states in the U.S. acquire significant

Q223: Social Security contributions are part of

A)excise taxes.

B)payroll

Q225: Which of the following statements about payroll

Q226: Joe complains that 32 percent of his

Q227: Which of the following is not an

Q228: Which is the most important source of

Q229: Which of the following is the largest

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents