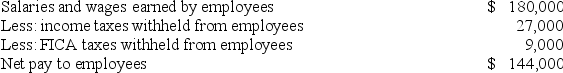

Red Mountain,Inc.has the following information from its payroll records:  The employer amount of FICA taxes that Red Mountain is required to pay is equal to the amount that it withholds from its employees.Assume no other payroll taxes are incurred at this time.What is Red Mountain's total expense with regards to this payroll?

The employer amount of FICA taxes that Red Mountain is required to pay is equal to the amount that it withholds from its employees.Assume no other payroll taxes are incurred at this time.What is Red Mountain's total expense with regards to this payroll?

A) $144,000

B) $153,000

C) $180,000

D) $189,000

Correct Answer:

Verified

Q21: A typical classified balance sheet provides no

Q22: Current liabilities are due:

A)but not receivable for

Q23: For the employee,net pay is equal to

Q24: Which of the following statements about payroll

Q25: A company typically records the amount owed

Q27: Redmont Company's gross salaries and wages are

Q28: The effective-interest method of amortization is considered

Q29: Payroll taxes paid by employees include which

Q30: Thomas Longbow is the only employee of

Q31: Which of the following must be paid

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents