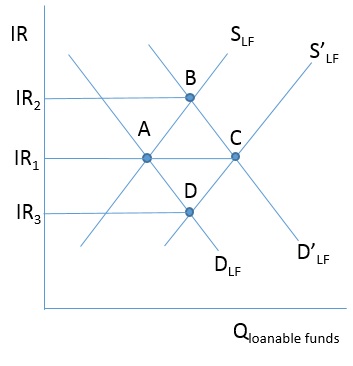

In the figure below, the loanable funds market is in equilibrium at A with the interest rate IR 1 . In conducting monetary policy, the Federal Reserve engages in the buying of US Treasury securities on the open market, which causes

A) no change in the loanable funds market, so the equilibrium interest rate remains at IR1.

B) the demand for loanable funds to increase to D', causing the equilibrium interest rate to increase to IR2.

C) both the demand for loanable funds and the supply of loanable funds to increase to D' and S' respectively, keeping the equilibrium interest rate at IR1.

D) the supply of loanable funds to increase to S', causing the equilibrium interest rate to fall to IR3.

Correct Answer:

Verified

Q15: Three rounds of extraordinary expansionary monetary policy

Q16: When the Federal Reserve increases the required

Q17: A financially healthy bank borrowing overnight from

Q18: In order to overcome the stigma that

Q19: When the Federal Reserve buys US Treasury

Q21: Of the policy tools available to the

Q22: When a negative shock to the economy

Q23: Which of these open market operations in

Q24: One of the Federal Reserve's most used

Q25: Times of financial uncertainty tend to cause

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents