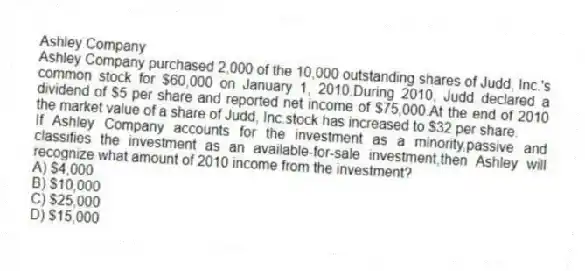

Ashley Company

Ashley Company purchased 2,000 of the 10,000 outstanding shares of Judd, Inc.'s common stock for $60,000 on January 1, 2010.During 2010, Judd declared a dividend of $5 per share and reported net income of $75,000.At the end of 2010 the market value of a share of Judd, Inc.stock has increased to $32 per share.

-If Ashley Company accounts for the investment as a minority,passive and classifies the investment as an available-for-sale investment,then Ashley will recognize what amount of 2010 income from the investment?

A) $4,000

B) $10,000

C) $25,000

D) $15,000

Correct Answer:

Verified

Q44: Olivia Co.owns 4,000 of the 10,000 outstanding

Q45: When an intangible asset has a finite

Q46: The _ method views a corporate acquisition

Q47: Under U.S.GAAP,when an asset's carrying amount is

Q48: Under which of the following scenarios would

Q50: Record Corporation

CD Inc.acquires 100% of the

Q51: Olivia Co.owns 5,600 of the 14,000 outstanding

Q52: When a foreign entity has the U.S.dollar

Q53: U.S.GAAP stipulates that firms should _ expenditures

Q54: Financial reporting requires firms to _ immediately

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents