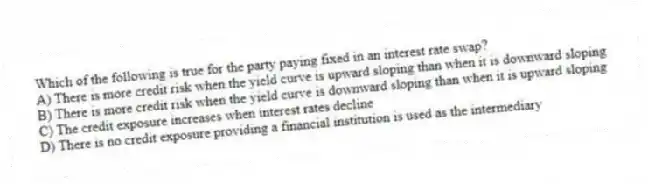

Which of the following is true for the party paying fixed in an interest rate swap?

A) There is more credit risk when the yield curve is upward sloping than when it is downward sloping

B) There is more credit risk when the yield curve is downward sloping than when it is upward sloping

C) The credit exposure increases when interest rates decline

D) There is no credit exposure providing a financial institution is used as the intermediary

Correct Answer:

Verified

Q2: Which of the following is a typical

Q4: Which of the following is a use

Q5: Which of the following is true for

Q7: Which of the following is usually true

A)

Q8: Which of the following describes the way

Q9: An interest rate swap has three years

Q16: Which of the following describes the five-year

Q17: A company enters into an interest rate

Q19: Which of the following is true?

A) Principals

Q20: A floating-for-fixed currency swap is equivalent to

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents