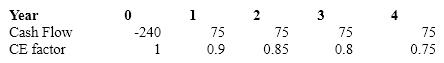

Zeta Inc.'s cost of capital is 12% and the risk-free rate is 5%. It plans to invest in a new project. The cash flow projections ($000) for the project are given below. Calculate the difference in the traditional NPV and the certainty equivalent NPV.

A) $9.43

B) $7.59

C) $30.35

D) $20.92

Correct Answer:

Verified

Q39: Why should a risk averse manager select

Q40: Scenario analysis for a proposed new project

Q41: The NPV and IRR of any capital

Q42: An abandonment option will have an upfront

Q43: A(n)_ is a graphic representation of a

Q45: Average stocks are yielding 7.0%, while short

Q46: Which of the following is an advantage

Q47: The _ makes risky projects less acceptable

Q48: The certainty equivalent factor can take any

Q49: A company is considering a project in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents