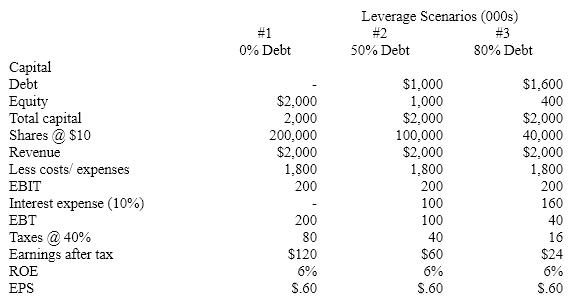

Consider the following leverage scenarios:  If under certain circumstances, financial leverage enhances performance measured by ROE and EPS, why does shifting from equity into debt have no effect in this case?

If under certain circumstances, financial leverage enhances performance measured by ROE and EPS, why does shifting from equity into debt have no effect in this case?

A) The company hasn't repurchased enough shares of stock with borrowed money.

B) The money the company is earning on its capital is exactly what it costs to borrow.

C) ROCE is too high.

D) ROCE is equal to the after tax cost of debt.

Correct Answer:

Verified

Q6: The use of fixed cost sources of

Q10: The increased variability in earnings per share

Q11: Financial leverage is a direct function of

Q12: A firm that employs a relatively large

Q13: The central issue in the study of

Q14: When the return on equity is equal

Q16: The term "financial leverage" originated from the

Q18: Financial leverage has the following effect on

Q19: Which of the following is true of

Q20: Financial leverage increases a firm's ROE and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents