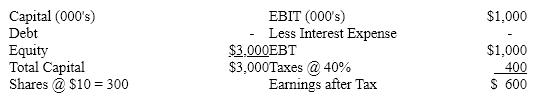

Assume the following facts about a company:  What will be the company's new EPS if it borrows money at 10% interest and uses it to retire stock until capital is 40% debt? The stock can be purchased at its book value of $10 per share.

What will be the company's new EPS if it borrows money at 10% interest and uses it to retire stock until capital is 40% debt? The stock can be purchased at its book value of $10 per share.

A) $3.33

B) $4.89

C) $2.93

D) None of the above

Correct Answer:

Verified

Q45: Which of the following assumptions was not

Q46: According to the MM model of capital

Q47: All other things being equal, the Modigliani

Q48: In the MM model, the risk of

Q49: The combined impact of operating leverage and

Q51: The degree of total leverage is equal

Q52: Which of the following is accepted wisdom

Q53: If a firm's sales change by 15%

Q54: Financial leverage amplifies relative changes in EBIT

Q55: A firm which has a 2.5 DOL

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents