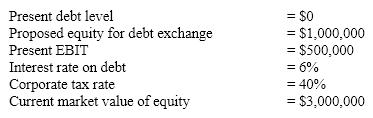

Assume the following selected financial information about a firm that is about to restructure capital by exchanging equity for debt:  What is the market value of the firm's equity after the restructuring according to the Modigliani-Miller model with taxes but without bankruptcy costs?

What is the market value of the firm's equity after the restructuring according to the Modigliani-Miller model with taxes but without bankruptcy costs?

A) $2,000,000

B) $2,264,000

C) $2,400,000

D) None of the above

Correct Answer:

Verified

Q76: Harris Inc. has EBIT of $1,500 and

Q77: Internet Corporation has EBIT of $1 million,

Q78: A firm has EBIT of $3.6M and

Q79: Assume the following facts about a firm

Q80: Wayside Corporation has an EBIT of $2

Q82: Zahn Enterprises pays $3 million annually to

Q83: Dittmar Corp. is considering an operational change

Q84: A firm's degree of financial leverage is

Q85: Financial risk is not directly associated with

Q86: Kermit's Hardware's (KH)fixed operating costs are $20.8

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents