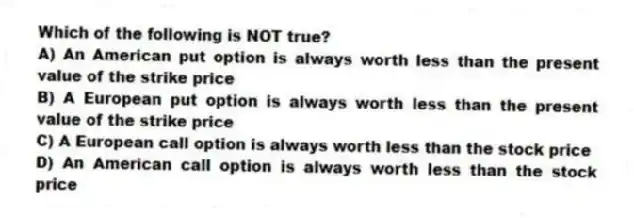

Which of the following is NOT true?

A) An American put option is always worth less than the present value of the strike price

B) A European put option is always worth less than the present value of the strike price

C) A European call option is always worth less than the stock price

D) An American call option is always worth less than the stock price

Correct Answer:

Verified

Q6: Which of the following is true for

Q9: Which of the following is true?

A) An

Q10: The price of a European call option

Q11: Which of the following is true when

Q13: Which of the following best describes the

Q13: Interest rates are zero.A European call with

Q16: When the time to maturity increases with

Q18: Which of the following can be used

Q19: When dividends increases with all else remaining

Q20: When interest rates increase with all else

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents