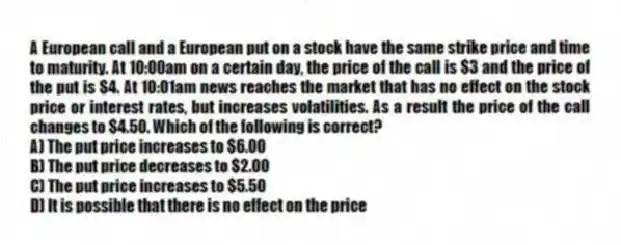

A European call and a European put on a stock have the same strike price and time to maturity. At 10:00am on a certain day, the price of the call is $3 and the price of the put is $4. At 10:01am news reaches the market that has no effect on the stock price or interest rates, but increases volatilities. As a result the price of the call changes to $4.50. Which of the following is correct?

A) The put price increases to $6.00

B) The put price decreases to $2.00

C) The put price increases to $5.50

D) It is possible that there is no effect on the price

Correct Answer:

Verified

Q2: When volatility increases with all else remaining

Q4: A stock price (which pays no dividends)is

Q5: Which of the following describes a situation

Q6: The price of a stock,which pays no

Q8: The price of a European call option

Q9: Which of the following is true?

A) An

Q12: When the strike price increases with all

Q13: Interest rates are zero.A European call with

Q14: Which of the following is the put-call

Q15: When the stock price increases with all

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents